The in-vehicle payment services market provides drivers with an easy way to pay for parking, tolls, food delivery and other in-car purchases without needing cash or cards. In-vehicle payment services integrate directly with a vehicle’s built-in systems allowing contactless payment through technologies such as NFC, DSRC or Bluetooth. This saves drivers time and hassle at the point of payment.

The global in-vehicle payment services market is estimated to be valued at US$ 7.24 Bn in 2024 and is expected to exhibit a CAGR of 10% over the forecast period 2024 to 2031, as highlighted in a new report published by Coherent Market Insights.

Market key trends:

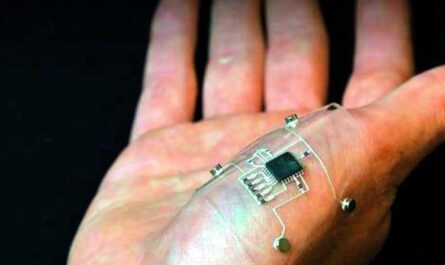

Some of the major trends driving growth in the in-vehicle payment services market include the rising popularity of connected cars and increasing adoption of digital payment methods. As more vehicles are equipped with advanced connectivity and built-in payment interfaces, demand is growing for services that allow drivers to pay for parking, tolls and food/coffee delivery directly from their car dashboards. This saves time and improves the driving experience. Additionally, as digital payment platforms like mobile wallets, debit/credit cards, and wearables gain widespread acceptance, consumers are more comfortable making contactless in-car payments. Technology firms and automakers are also partnering to develop standardized in-vehicle payment solutions. For example, major companies like Apple, Amazon and Google are integrating their digital wallet services with new vehicle models. As connectivity and payment technologies continue to advance, the in-vehicle payment services market is expected to see strong double digit growth over the next decade.

Porter’s Analysis

Threat of new entrants: The threat of new entrants in the In-Vehicle Payment Services market is moderate. Established players dominate the market and new entrants require substantial investment in technology which poses a barrier.

Bargaining power of buyers: The bargaining power of buyers is high in this market. Buyers have a variety of options to choose from and can switch between providers easily.

Bargaining power of suppliers: The bargaining power of suppliers is moderate. While a few prominent technology companies operate as suppliers, they do not dominate the market.

Threat of new substitutes: The threat of substitutes is moderate. Alternate modes of contactless payment are emerging but in-car integration provides unique convenience.

Competitive rivalry: Competition in the market is high and intensifying as players compete on technology, partnerships and customer experience.

Key Takeaways

Global In-Vehicle Payment Services Market Size is expected to witness high growth over the forecast period.

Regional analysis: North America dominates the market currently due to high adoption of connected car technologies. Asia Pacific is expected to grow at the fastest pace led by China and India as vehicular ownership rises in the region.

Key players: Key players operating in the In-Vehicle Payment Services are Apple Inc., Amazon Renewed, Samsung Electronics, Best Buy Co., Inc., Gazelle (a subsidiary of ecoATM Gazelle LLC), Newegg Inc., Decluttr, Back Market, HP Inc., GameStop Corp., Swappa, BuyBackWorld, eBay Inc., Renewgoo, Music Magpie. Apple Pay and Android Pay currently have a significant presence in-car but integration with more vehicle brands is expected. Partnerships between OEMs, payment gateways and telecom operators will also shape the competitive landscape.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it