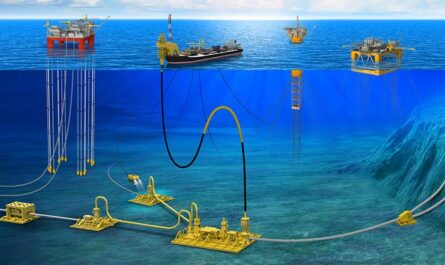

Offshore decommissioning refers to the process of ending operations of offshore oil and gas facilities and returning the seabed to its original state of nature. This involves plugging and abandoning of wells, removal of topsides and jackets and site clearance. Decommissioning helps restore environmental habitat and protect public safety.

The global Offshore Decommissioning Market is estimated to be valued at US$ 7.07 Bn in 2023 and is expected to exhibit a CAGR of 16% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market key trends:

Several countries have framed new regulations to ensure complete removal of offshore structures post production life. For instance, under UK regulations, operators are required to obtain permission from authorities before starting decommissioning work and submit detailed decommissioning program. Moreover, full removal of structures is mandatory unless safety and environmental risks permit partial removal. Such regulations are compelling offshore operators to invest heavily in decommissioning activities.

SWOT Analysis

Strength: The offshore decommissioning market has stringent regulations related to offshore decommissioning which ensures steady work for players. With mature oilfields going for decommissioning, it ensures long term business opportunities.

Weakness: Decommissioning of offshore assets requires specialized ships and equipment which requires huge capital investments. Logistical challenges associated with transporting huge structures from offshore can increase project costs.

Opportunity: Growing decommissioning of offshore oil and gas assets driven by depletion of fields and shift to renewables creates multi-billion dollar decommissioning market. New technologies can help reduce project timelines and costs.

Threats: Volatility in crude oil prices can impact decommissioning budgets of exploration companies. Substitute energy sources like shale gas reduces requirement of offshore fields impacting future decommissioning projects.

Key Takeaways

The Global Offshore Decommissioning Market Size is expected to witness high growth, exhibiting CAGR of 16% over the forecast period, due to increasing number of mature offshore oil and gas fields reaching end of field life. Over 2300 offshore oil and gas fields globally are expected to reach end of field life during 2023-2030.

Regional analysis

North America dominated the offshore decommissioning market in 2023 with around 25% share due to large number of outdated offshore rigs and platforms in Gulf of Mexico reaching end of operational life. Europe is also a significant market led by the UK sector of North Sea which has aging offshore infrastructure. With over 500 platforms planned for decommissioning in North Sea during 2023-2030, Europe market is poised to account for over 20% share during the forecast period.

Key players

Key players operating in the offshore decommissioning market are Acteon Group Limited, Topicus Finan BV, AF Gruppen ASA, Tetra Technologies Inc., Allseas Group S.A., DeepOcean Group Holding B.V., John Wood Group Plc, and Exxon Mobil Corporation. Major players are focusing on joint ventures and mergers & acquisitions to gain expertise in niche and specialized decommissioning projects.

Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it