History and Growth of KSA Tire

KSA Tire was established in 1970 in Jeddah by Khalid Abdulaziz Abdul Latif. Starting off as a small tire retail shop, the company saw steady growth over the years by expanding its network of dealerships across major cities in Saudi Arabia. In 1990, KSA Tire opened its first manufacturing plant in Dammam with an investment of $50 million to produce radial tires for passenger cars and light trucks. This marked KSA Tire’s foray into tire manufacturing and helped the company reduce its reliance on imported tire brands.

Over the next decade, KSA Tire focussed on ramping up production at its Dammam plant and strengthening its distribution network. By 2000, the company had become the largest tire manufacturer and retailer in the kingdom with a market share of over 30%. To meet growing demand, a second manufacturing plant was set up in Jeddah in 2005 at a cost of $100 million which doubled KSA Tire’s annual production capacity. The company also introduced its popular ‘Durahil’ brand of truck and bus radial tires in the commercial vehicles segment.

Dominant Position in the Domestic Market

Currently, KSA Tire operates three manufacturing plants located in Dammam, Jeddah and Hail with an overall annual production capacity of 12 million tires. The company has a wide range of tire products for passenger cars, SUVs, light commercial vehicles, trucks and buses. Through its network of over 500 dealerships and fitting centers across Saudi Arabia, KSA Tire is able to serve both retail and commercial customers efficiently.

According to industry reports, KSA Tire commands a market share of around 45-50% in the overall Saudi tire market. Its closest competitors such as Michelin and Bridgestone have only 5-10% shares each. When broken down by segments, KSA Tire leads in the passenger car radial and commercial vehicle tire categories with over 60% and 40% shares respectively. The strength of its distribution network and decades of experience in the local market conditions have helped the company gain an unassailable position.

Diversifying into New Sectors

While KSA Tire remains focused on growing its dominance in the Saudi automotive tires industry, the company has started diversifying into related sectors in recent years. In 2015, it set up a joint venture with a European company to manufacture tread rubber and other tire components at its Dammam plant. This backward integration facility supplies a major portion of KSA Tire’s raw material needs and has strengthened the company’s manufacturing supply chain.

Another noteworthy diversification was the acquisition of a 50% stake in a local automotive workshops chain in 2018. Under this deal, the workshops now exclusively use and promote KSA Tire products while carrying out vehicle servicing and repairs. The company believes such vertical integration will help expand the aftermarket sales of its tires. KSA Tire is also exploring opportunities in retreading solutions as discarded tires offer a big market for recycled tire sales and services.

Focus on R&D and Advanced Technologies

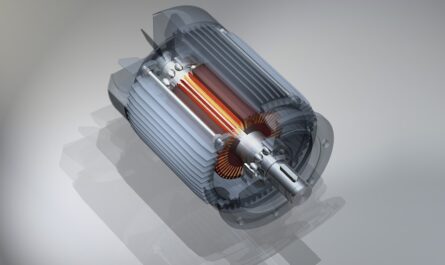

While maintaining a sharp focus on the needs of the Saudi market, KSA Tire places strong emphasis on research and development activities. It has an in-house R&D center and laboratory at its Dammam plant which works on new tire designs, compounds and production processes. Over the years, the R&D team has introduced innovations such as customized tires for domestic construction equipment and harsh desert conditions in the kingdom.

The company is now working to incorporate several advanced automotive technologies into its tires. This includes self-sealing tires that can heal punctures on their own and tires integrated with sensors to monitor pressure, temperature and wear life remotely. KSA Tire is collaborating with international tech companies on research relating to smart, connected and autonomous vehicles. It aims to launch the first Saudi-made tires integrated with advanced components and digital solutions by 2025.

While KSA Tire faces rising competition from multinational brands, its early mover advantage, strong local dominance and focus on R&D is expected to help the company maintain leadership in the foreseeable future. With projected automotive market growth in Saudi Arabia, there are lucrative opportunities for further expansion both within and outside the kingdom. Backed by its robust financials and diversification moves, KSA Tire looks well placed to capitalize on these opportunities and cement its position as the clear market leader in the Saudi tire industry for years to come.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it