The Carbon Black Market is estimated to be valued at US$ 1,156.1 Mn in 2023 and is expected to exhibit a CAGR of 7.5% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

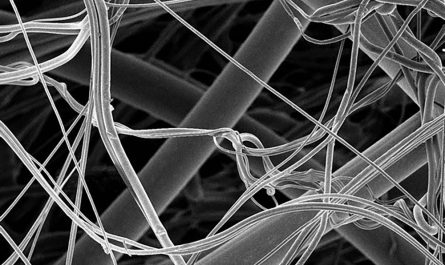

Carbon black is a material produced by the incomplete combustion of heavy petroleum products like petroleum oil or natural gas. It is made up of tiny particle having spherical shape and amorphous nature. Carbon black has high tinting strength, UV protection, and reinforcing properties and thus largely used as a black pigment and reinforcing filler in the production of tires, mechanical rubber goods, and other polymer products. It enhances the durability, tensile strength and wear resistance of the rubber products.

Market Dynamics:

Growth of the automotive industry is one of the major drivers of the carbon black market. According to the International Organization of Motor Vehicle Manufacturers, around 93 million vehicles were produced globally in 2018 alone. This growing automotive production has significantly increased the demand for rubber products like tires and hoses, which in turn is driving the carbon black market. Additionally, increasing use of carbon black as a UV light absorber and reinforcing filler in the plastics and coatings industry is further fueling market growth. Due to its conductivity properties, carbon black finds wide application as an additive in plastics, inks, toners, batteries, and other products.

Segment Analysis

The global carbon black market is dominated by the rubber segment which accounts for over 90% of the total consumption. Carbon black is used as a reinforcing filler and pigmenting agent in the production of tires and other rubber products like belts, hoses and gaskets. The tire industry consumes more than half of the total carbon black produced globally owing to the immense requirement of reinforcing carbon black to manufacture tires that are durable, strong yet lightweight.

PEST Analysis

Political: The environmental regulations regarding carbon emission from industries and vehicles are getting stringent globally which is positively impacting the demand for specialty carbon blacks with low PAH content from the rubber segment.

Economic: The growth in automobile production and sales especially in developing economies of Asia Pacific is driving the demand for tires and subsequently carbon black from the rubber segment.

Social: Rising disposable income and preference for personal vehicles over public transport is augmenting the demand for new vehicles which in turn boosts the carbon black consumption.

Technological: Continuous research towards developing specialty grades of carbon black with low rolling resistance and abrasion for prolonged tire life without compromising on other properties is opening new avenues of growth.

Key Takeaways

The Global Carbon Black Market Size is expected to witness high growth, exhibiting CAGR of 7.5% over the forecast period, due to increasing automobile production worldwide. The Asia Pacific region is expected to be the fastest growing as well as the largest market during the forecast period. China dominates the global production and demand for carbon black accounting for over 50% of the total volume. Key players operating in the carbon black market are Orion Engineered Carbons, Cabot Corporation, Mitsubishi Chemical Corporation, Phillips Carbon Black Limited, Birla Carbon, Sid Richardson Carbon & Energy Co., Anyang HengXu Specialty Carbon Black Co., Ltd., and Imerys Graphite & Carbon.

The global carbon black market size for 2023 is estimated to be US$ 1,156.1 Mn. Regional analysis – The Asia Pacific region dominated the global carbon black market in 2022 and the trend is expected to continue during the forecast period owing to massive automobile production clusters in China, India, Japan and other Southeast Asian countries. China accounted for over 50% of the global carbon black production and demand in 2022.

Key players analysis – Key players operating in the carbon black market are focusing on capacity expansion, mergers & acquisitions and introduction of specialty grades to cater to the evolving needs of end use industries. In 2023, Orion Engineered Carbons announced plans to set up a new production facility worth US$ 50 million in Texas, USA to meet the growing carbon black demand from the tire industry in North America. Birla Carbon also inaugurated a specialty black production line worth US$ 25 million in Brazil in 2023 to enhance its product portfolio in Latin America.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it