The Global Battery Materials Market is estimated to be valued at US$50.6 billion in 2022 and is expected to exhibit a CAGR of 6% over the forecast period 2023 to 2030, according to a report published by Coherent Market Insights.

Market Overview:

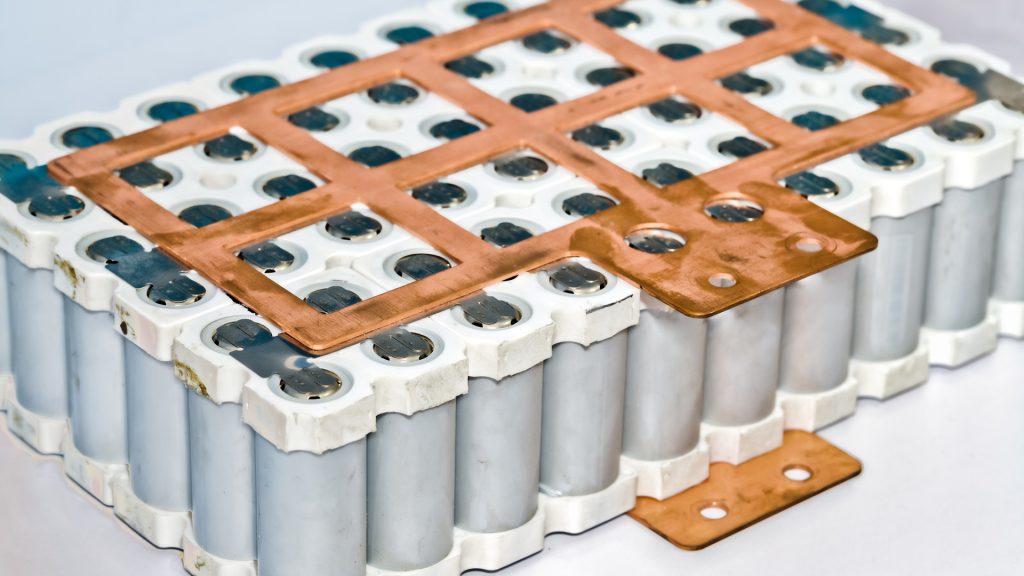

The Battery Materials Market includes materials used in the production of different types of batteries, such as lithium-ion batteries, lead-acid batteries, and nickel-metal hydride batteries. These materials are crucial for the efficient functioning and performance of batteries. The increasing demand for batteries in various applications, such as consumer electronics, electric vehicles, and renewable energy storage systems, is driving the market growth. With the rapid growth in the electric vehicle industry and the rising adoption of renewable energy sources, the demand for battery materials is expected to witness significant growth in the coming years.

Market Key Trends:

One key trend observed in the Battery Materials Market is the growing focus on the development of advanced battery materials for enhanced performance and sustainability. With the increasing demand for high-energy density batteries and longer battery life, manufacturers are investing in the research and development of innovative battery materials. For instance, advancements in lithium-ion battery technology, such as the use of silicon-based anodes and solid-state electrolytes, are being explored to improve the energy storage capacity and safety of batteries. This trend of technological advancements in battery materials is expected to drive market growth and create new opportunities in the coming years.

Porter’s Analysis

Threat of New Entrants:

The battery materials market poses a moderate threat of new entrants due to significant barriers to entry. High capital requirements for setting up battery materials production facilities, along with stringent regulations and licensing processes, limit the entry of new players. Additionally, established companies already benefit from economies of scale, advanced technologies, and strong distribution networks.

Bargaining Power of Buyers:

Buyers in the battery materials market hold moderate bargaining power due to the availability of multiple suppliers and a competitive landscape. However, buyers who require large quantities of battery materials may have greater negotiating power, especially if they have long-standing relationships with key suppliers.

Bargaining Power of Suppliers:

Suppliers in the battery materials market wield high bargaining power. The market relies on a limited number of suppliers for key elements such as lithium, cobalt, and nickel. Any disruptions or price fluctuations in the supply chain can significantly impact the overall pricing and availability of battery materials.

Threat of New Substitutes:

The threat of substitutes in the battery materials market is relatively low. Battery technologies are continuously evolving, but alternatives to lithium-ion batteries, such as solid-state or flow batteries, are still in the experimental or early stages of development. Hence, lithium-ion batteries remain the dominant choice for energy storage applications.

Competitive Rivalry:

The battery materials market is characterized by intense competition among key players. Companies compete based on factors such as product quality, cost-efficiency, innovation, and market presence. As the demand for batteries grows, players focus on expanding their production capacities, entering strategic partnerships, and investing in research and development to gain a competitive edge.

Key Takeaways

The Global Battery Materials Market Size is projected to exhibit robust growth, showcasing a Compound Annual Growth Rate (CAGR) Of 6% between 2023 and 2030. This growth can be attributed to the increasing adoption of electric vehicles, rising investments in renewable energy storage systems, and the growing demand for portable electronic devices.

In terms of regional analysis, Asia Pacific is expected to emerge as the fastest-growing and dominating region in the battery materials market. The region’s strong manufacturing base, growing population, supportive government policies, and surging demand for electric vehicles facilitate market expansion. China, in particular, plays a crucial role as a major consumer and producer of battery materials.

Key players operating in the battery materials market include Albemarle, China Molybdenum Co. Ltd., Ganfeng Lithium Co., Ltd., Glencore PLC, Livent Corporation, Norilsk Nickel, Sherritt International Corporation, SQM S.A., Targray Technology International Inc., Teck Resources, Tianqi Lithium, and Vale S.A. These players are constantly engaged in strategic initiatives such as mergers and acquisitions, partnerships, and capacity expansions to strengthen their market position and meet the growing battery material demand.

In conclusion, the battery materials market presents significant growth opportunities driven by the increasing demand for electric vehicles and renewable energy storage. Key players need to focus on technological advancements, sustainable sourcing of raw materials, and expanding their presence in emerging markets to stay competitive in this dynamic industry.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it